When Does a Company Need SaaS Management? Minimum Employee Threshold Explained

Hiring that fuels rapid growth also quietly expands a SaaS footprint that can swamp lean teams fast. Every badge added to Slack, Jira, or HubSpot brings along logins, licenses, and data trails that finance, IT, and security must track, so renewals and audits don’t slip through the cracks.

At fifty people, spreadsheets already groan when someone asks who owns Zoom or Figma. By a hundred, procurement rules, SOC 2 checklists, and shadow IT alerts stack up faster than finance can trace paid seats. Past two hundred, duplicate SaaS contracts start hiding real waste. Each stage exposes predictable breakpoints where manual tracking snaps, budgets blur, and auditors lose patience.

Spotting both headcount and tooling signals early lets a growing company green-light a SaaS Management Platform before cost and risk run wild.

Table of Contents

- Why does headcount complicate SaaS oversight?

- What headcount milestones are key tipping points?

- What non-headcount signals show you need SaaS management?

- How does rapid growth raise SaaS risk?

- Conclusion

- Audit your company's SaaS usage today

Why does headcount complicate SaaS oversight?

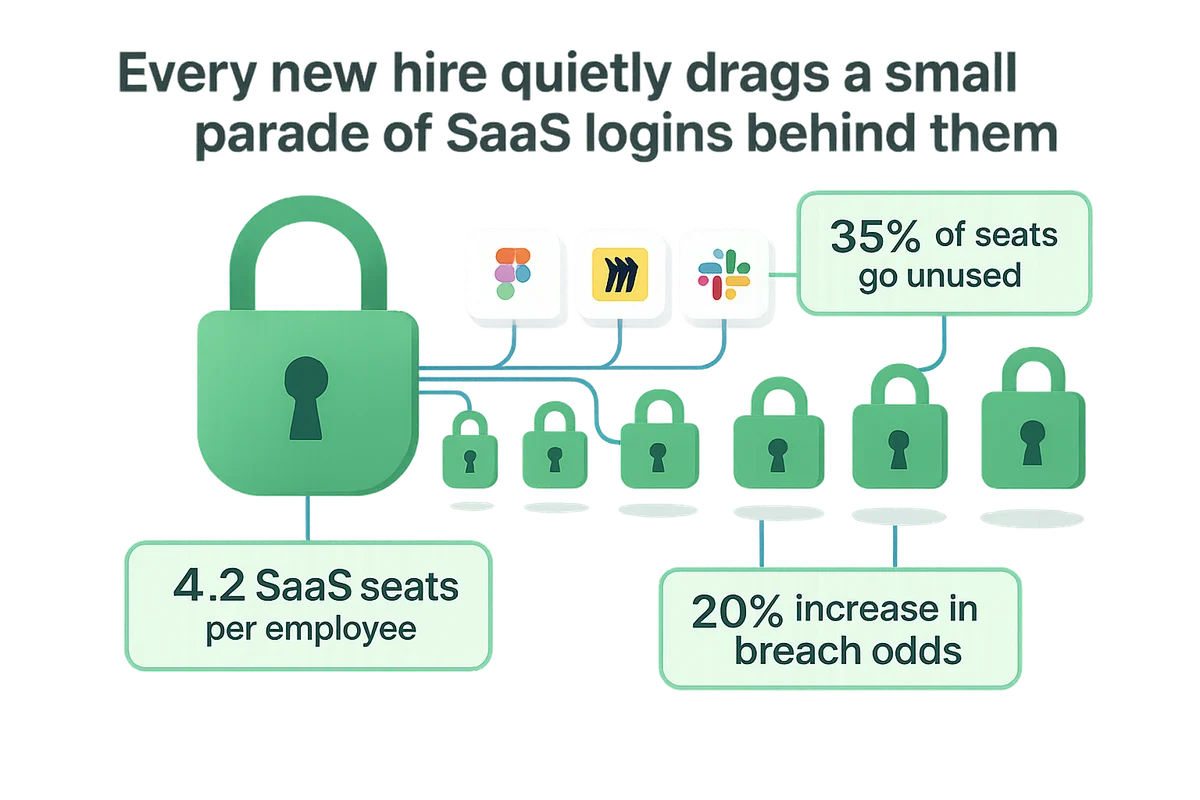

Every new hire quietly drags a small parade of SaaS logins behind them. Designers typically need Figma, Miro, Slack, and Zoom on day one, while finance issues NetSuite and Expensify before lunch. Add ten hires in a quarter and you’re juggling more than sixty fresh credentials, each holding customer data, billing strings, and renewal timers no one has memorized.

Those logins represent more than icons on a dock; each one is a cost center, a potential attack surface, and a compliance obligation. The math stacks up fast:

- Average midsize firms issue 4.2 SaaS seats per employee, according to Productiv’s 2023 index

- License cost per worker sits near $3,000 a year, yet 35% of seats go unused

- A single forgotten admin account increases breach odds by 20%, Verizon DBIR shows

What looks like simple headcount growth can snowball hard and fast. Traditional on-prem software stays mostly fixed; you buy a server, add some VM cores, and keep trucking. Cloud tools scale by user count, feature tier, and data volume all at once, so your cost and risk curve bends upward, not sideways. Two hundred employees doesn’t just double the oversight burden of one hundred; it can triple it because of tier jumps, security groups, and regional data residency rules that kick in beyond certain thresholds.

Auditors and cyber-insurers notice that rising curve long before leadership does. Once you cross a few dozen unique apps, they expect evidence of license tracking, periodic access reviews, and documented offboarding within 24 hours of departure. Fail to produce it and premiums spike or coverage shrinks. The scramble to download access logs or locate last year’s Salesforce invoice usually ends with someone swearing they’ll “get a system in place.” By then, headcount growth has already outrun manual lists, leaving IT, finance, and security reacting instead of steering.

What headcount milestones are key tipping points?

Certain headcount milestones flip SaaS management from casual chore to daily fire drill, and the shift arrives faster than most teams anticipate.

At roughly fifty employees, the first full-time finance or IT operations hire steps in and asks where the license ledger lives. Founders have usually been tracking subscriptions in scattered email threads or a shared spreadsheet. Once weekly onboarding tops two new faces, that file drifts out of sync. Seats stay active after departures, Slack workspaces multiply, and nobody can recall who still holds the Zoom admin role. Gartner puts annual SaaS spend near $4,200 per user at this size, so even a few ghost accounts can equal an entire paycheck.

Crossing one hundred employees introduces governance headaches that sticky notes and spreadsheets cannot handle. A SOC 2 readiness push needs evidence of access reviews and renewal controls. Legal wants master service agreements in one place. Procurement rolls out intake forms in hopes of slowing the shadow IT flood, yet product managers still swipe cards to try ClickUp or Figma. Blissfully reports that companies at this stage average 75 distinct SaaS apps, while a typical single sign-on portal covers only half. Manual true-ups every quarter burn whole days for finance analysts.

Operational complexity spikes again near the two-hundred mark when departments control their own software budgets and new offices spin up worldwide. Two marketing leads might buy identical analytics suites before anyone notices. Regional privacy rules add separate retention settings. Running this swirl without automation feels like doing payroll in a text file. The specific pain points show up in patterns like:

- Separate owners for the same platform in different regions

- Stacked renewal dates that threaten cash flow forecasting

- Overlapping features across three or more project management tools

- Security reviews delayed because admin logs sit in local inboxes

By two hundred staff, the average firm juggles more than 120 subscriptions and spends over one million dollars a year on SaaS. Spreadsheet triage cannot keep up; unified discovery, workflow, and cost controls shift from nice-to-have to survival gear.

What non-headcount signals show you need SaaS management?

Annual headcount isn’t the only alarm bell when SaaS chaos starts draining time and cash.

In most companies, finance clocks the pain before anyone else. One Monday they notice subscription charges topping half a million dollars a year; by Friday they’re reconciling six corporate cards, each paying different tiers for the same video-conferencing tool. When spend jumps yet no one can explain which team owns what, a lightweight spreadsheet stops cutting it.

The most glaring quantitative cues appear in usage logs and invoices. If any three of the signals below ring a bell, a SaaS Management Platform shifts from nice-to-have to must-have:

- Total SaaS spend passes $500K or 1% of revenue, whichever arrives first

- More than 40 unique cloud apps show up in SSO, CASB, or finance exports

- Duplicate contracts appear, for example, two Trello workspaces, three Zoom accounts, four Datadog orgs

- Finance or IT burns over eight hours a month matching licenses to cost centers

- More than 15% of paid seats sit inactive for 90 days or longer

While the numbers tell one story, qualitative red flags appear just as quickly. Marketing signs a new design tool on a purchasing card, unaware that Product already pays for a similar license. Renewal reminders sit in inboxes because the original champion left last quarter. Security reviews stall because no one remembers who controls the admin key. These softer indicators rarely land on a KPI dashboard, yet they torch productivity and invite audit findings.

Spot the patterns early, and the ROI on centralized SaaS management shows up before the next budgeting cycle wraps.

How does rapid growth raise SaaS risk?

Rapid hiring feels like momentum, yet it quietly rewrites the SaaS risk equation. Once headcount jumps by double digits each quarter, the steady trickle of new accounts turns into a flood and manual workflows groan. Okta data shows that companies adding 15 percent staff per quarter log a 28 percent jump in fresh SaaS subscriptions over the same period, and the gap keeps growing as hiring continues.

The real operational drag finally shows up during frantic employee onboarding sprints. A people team might line up thirty starts for the first Monday of the month, yet IT still leans on a spreadsheet checklist. Every missed step piles up: accounts left in limbo, contractors waiting on access, admins copying settings from the last hire. When Atlassian grew past 6,000 employees, it found that a single day of delayed access cost nearly three hours of productivity per person. Multiply that across a full cohort and a six-figure quarterly leak appears.

Operational chaos is only part of the story; cash flow takes the hit. Bursty hiring wrecks tidy renewal calendars, and twenty percent of contracts can now expire inside a single week. Finance scrambles for usage numbers, vendors smell urgency, and early-pay discounts disappear. Without a SaaS Management Platform to align start dates and forecast seat demand, teams overbuy just to stay safe. A CFO survey from Blissfully showed high-growth firms carrying 35 percent more unused licenses than steadier peers.

Security debt, often invisible day-to-day, builds just as quickly as headcount. Offboarding drags behind departures, leaving orphaned accounts that auditors and insurers flag right away. When Zoom quadrupled its workforce in two years, it uncovered dormant GitHub repos still tied to former engineers, each holding sensitive deployment keys. Yet the most common gap isn’t code; it’s stale OAuth tokens tied to third-party apps no one remembers approving.

Rapid scale doesn’t simply amplify friction, it spawns new risks in real time. A dedicated SaaS Management Platform gives growing companies the one thing they lack: breathing room while the headcount counter keeps spinning.

Conclusion

Rapid growth feels great until your SaaS stack doubles overnight and budgets blur together. Each new hire adds seats, logins, and risks that pile up faster than outdated on-site servers. When headcount climbs past 50, 100, or 200 people, the cracks show as audits loom, budgets fracture, and shadow IT spreads. Even a small team can hit the same wall when spend, app count, or release speed accelerates.

Pick a SaaS management platform before headcount or chaos reaches the tipping point. Seeing the full picture beats another last-minute scramble.

Audit your company’s SaaS usage today

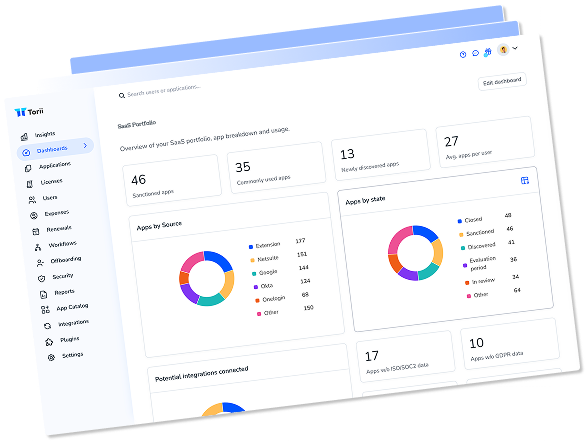

If you’re interested in learning more about SaaS Management, let us know. Torii’s SaaS Management Platform can help you:

- Find hidden apps: Use AI to scan your entire company for unauthorized apps. Happens in real-time and is constantly running in the background.

- Cut costs: Save money by removing unused licenses and duplicate tools.

- Implement IT automation: Automate your IT tasks to save time and reduce errors - like offboarding and onboarding automation.

- Get contract renewal alerts: Ensure you don’t miss important contract renewals.

Torii is the industry’s first all-in-one SaaS Management Platform, providing a single source of truth across Finance, IT, and Security.

Learn more by visiting Torii.