5 Pitfalls of Letting Each Department Manage Its Own SaaS Vendors

Swiping a card and spinning up a new SaaS tool feels liberating. If no one reins it in, that comfort splinters the tech stack, hides costs, creates governance gaps, and dampens data flow.

IT teams usually notice the sprawl only after a renewal notice lands on finance’s desk. By then, duplicate CRM plugins, shadow invoices, silent feature updates, and disconnected data streams have already drained budgets and heightened security exposure far beyond what any single department intended. Catching the issue early demands a purchasing model that balances autonomy with shared oversight. Left unaddressed, these small leaks erode planning accuracy and make CFOs question every forecast marketing or product hands them.

Below, we break down how scattered SaaS buying fuels redundancy, overspend, risk, data silos, and weak leverage, and we share practical next steps.

Table of Contents

- Why do duplicate SaaS tools appear?

- How do decentralized purchases inflate SaaS spend?

- What security risks come from disconnected vendor lists?

- How do siloed SaaS tools hurt integration?

- How do fragmented contracts weaken vendor leverage?

- Conclusion

- Audit your company's SaaS usage today

Why do duplicate SaaS tools appear?

Departments love the freedom to swipe a card and spin up a new app. That same freedom sprouts a cluster of copycat tools, and no one upstairs realizes they’re paying to keep them alive.

When each team buys software alone, redundancy shows up almost overnight. Marketing’s HubSpot workspace adds an e-signature plug-in, while Legal already funds DocuSign. Sales spins up Monday.com because it matches their pipeline view, ignoring that Product built detailed workflows in Asana last quarter. No notification, no central catalog, no flag at checkout. The result is a patchwork of logins that seems harmless until the lineup of logos dwarfs the work itself.

- Two CRMs living side by side, each with its own lead object

- Three project boards that map the same sprint, yet use different ticket IDs

- Separate chatbots pulling from diverging knowledge bases

- A marketing automation suite that replicates features native to the primary CRM

Execution time takes the hit long before Finance notices the bill. Revelo’s 2022 productivity study found employees lose about nine percent of their day shuffling between apps; the loss climbs when screens look alike but store different data. A rep bouncing from Trello to Monday, then back to Salesforce, types the same note three times. Multiply that by forty sellers over a quarter’s activity, and opportunity updates lag while dashboards contradict each other.

So why do even seasoned employees still cling to duplicate tools? Familiar muscle memory leads the pack. A designer prefers Figma’s comments, Engineering trusts Miro for whiteboards, and neither wants to relearn shortcuts under a corporate edict. Teams also treat tool choice as proof of autonomy; giving it up can feel like slowing down. Without a clear list of approved vendors, every swipe of the card deepens the silo and makes the next overlap easier to excuse. Broad visibility, not a heavy-handed ban, breaks the cycle before another “must-have” subscription sneaks through.

How do decentralized purchases inflate SaaS spend?

Department-led SaaS buying often looks harmless until the first true-up, then the finance inbox lights up with five invoices for what should be one product.

Card-based checkout skips procurement checks, so the same pattern repeats across e-signature, storage, and video conferencing. Gartner estimates that 25 percent of SaaS spend now hides outside formal purchasing systems, and Zylo puts unused licenses around 30 percent of the bill. Those dollars never hit the consolidated ledger, so budget owners plan against numbers that are already wrong.

Most SaaS vendors quietly set their pricing rules to punish fragmentation. The Pro tier might run twenty dollars a seat, yet slide to twelve once you cross 500 licenses. Split that headcount across three contracts and the discount never unlocks. Multiply that gap by every tool with tiered pricing and the enterprise drags a quiet tax behind every renewal.

In many organizations, renewals turn into the biggest leak of all. Auto-charge schedules roll over on Sunday nights when no one is watching, and bill-by-email invoices drift past AP filters. The CFO sees the spend only when cash variance spikes. Look for these red flags:

- Department cards hitting their monthly limit on the same day each quarter

- Multiple invoices from the same vendor but different sender addresses

- Slack or Teams channels asking, “Who owns this contract?” just days before renewal

Clear visibility, rather than layers of bureaucracy, fixes the bulk of this waste. A lightweight form inside the existing ticketing tool can route new app requests to finance for ten-minute checks on overlap and pricing tiers. Pair that with a federated steering committee (one rep per business unit meets monthly) to share upcoming renewals and seat counts. These quick moves protect team autonomy while letting finance run a single spend dashboard. Companies that centralize only the catalog, not the decision, often reclaim 15 to 20 percent of annual SaaS outlay within one budget cycle.

What security risks come from disconnected vendor lists?

Missing apps that never make it into the central inventory leave openings auditors note and attackers probe. Security often assumes single sign-on covers every workspace, yet stray tenants still allow direct logins and keep production data. When a breach lands, no one can say who granted which permissions. Under GDPR, an undocumented processor remains the company’s responsibility, so finance faces fines up to four percent of revenue.

The 2022 GitHub breach, sparked when OAuth tokens lifted from Heroku integrations reached private repos, showed this gap clearly. GitHub later listed roughly 100 affected organizations, but the first alert depended on repos speaking up.

A living vendor inventory lets security record four key details that close these gaps fast.

- OAuth scope granted, and each user token with its last activity date.

- Data classification tag, such as customer PII or source code, per workspace.

- Compliance documents on hand like SOC 2, ISO 27001, or DPAs.

- Business owner of record who approves access changes and renewals.

When those fields live in a shared dashboard, auditors trace exposure in minutes rather than days. That same view feeds DLP engines that flag unsanctioned uploads the moment they happen.

Centralization never forces teams onto one tool; it simply runs every purchase through the same intake pipe. Connect that pipe to the identity provider, the CASB, and a weekly export from corporate cards, then trigger security review on day one. Pair the intake with quarterly access reviews to flush dormant accounts before stale keys pile up. Teams keep choosing what helps them work, and the business finally sees the true blast radius.

How do siloed SaaS tools hurt integration?

When each team picks its own SaaS, the data goes quiet. Sales dumps contacts into Salesforce, marketing builds look-alike audiences in HubSpot, and finance logs invoices in NetSuite. None of the apps share a common ID, so one customer can hide behind three email addresses, five phone numbers, and a half-written address. Reports turn into guesswork because dashboards add, drop, or double-count records depending on which system they fetch.

Data engineers try to stitch the chaos together, but every vendor updates on a different schedule. One week a field changes its name, the next week an API version retires, and nightly jobs start failing without warning. A single mapping slip then rolls through forecasts, churn models, and even automated discount approvals that lean on those numbers.

Common pain points surface fast:

- Date formats conflict and break time-series charts.

- Look-up tables drift when the product catalog changes in only one system.

- Critical events such as refunds sit in free-text notes that never reach the warehouse.

- Machine-learning pipelines starve because the inputs never land in the same S3 bucket.

Marketing spots the fallout when click-through rates look great but revenue lags. Creative isn’t the issue; the systems are misaligned. HubSpot calls a prospect “won” once a stage flips, while Salesforce waits for a signed order. With no shared schema, leadership argues about whose total is right instead of which campaign deserves more budget.

A simple governance checkpoint finally keeps the sprawl in check. Ask new SaaS buyers to list expected data flows, integration endpoints, and a name for break-fix support before procurement signs. Enterprise architects review once instead of rebuilding forever, letting teams stay nimble while protecting a single source of truth.

How do fragmented contracts weaken vendor leverage?

Too many bite-sized SaaS deals chip away at bargaining power companies thought they had. Vendors see twenty seats instead of two hundred and adjust pricing, priority, and feature plans so. With usage data scattered across five invoices, procurement can’t prove the total value on the table, so deeper discounts and premium support never materialize.

Sales reps won’t complain about the sprawl because it turns one renewal into five. Now they get five shots at an upsell, five rounds of legal review, and five separate auto-renew clocks to their advantage. The pain shows up fast:

- More dollars per seat because every micro-deal lands in the weakest discount tier

- Bare-bones support terms, so outage credits rarely apply

- Zero influence on product direction or security priorities

- Duplicate portals and license keys clogging the asset tracker

When leverage slips, service levels are usually the first thing to break. When the January 2021 Slack outage hit, enterprise clients on unified plans got live engineering updates and automatic credits, while small-team contracts waited in a public status queue. The same pattern shows up in Zoom premium support, where response times fall from one hour to 24 hours if spending misses the enterprise cutoff by just a few thousand dollars. A single delayed ticket can stall a board meeting or customer webinar, yet the price gap often equals one month of redundant licenses.

The confusion multiplies when those scattered contracts come up for renewal. Each department tracks contract anniversaries in separate spreadsheets, so finance can’t stage a consolidated RFP, and legal ends up redlining the same indemnity clause five times. Centralizing dates in a shared calendar is an easy first win; aligning those dates so 80 percent of agreements expire in Q4 is even better because it turns scattered leverage into a focused negotiation season.

A blended approach keeps the pace teams like while restoring purchasing muscle. Let teams trial new tools, but route every purchase above a seat or spend threshold through a light procurement desk that bundles volumes, standardizes terms, and syncs renewals. Vendors listen when the whole company speaks with one contract.

Conclusion

Team-level SaaS purchases feel quick at first, yet they soon slow the entire company. Duplicate apps accumulate, bloating budgets without a clear owner, while security teams scramble to vet tools they never approved. Fragmented data breaks dashboards and stalls AI initiatives, and separate contracts force teams to negotiate for discounts the organization has already earned.

A single, company-wide procurement model resolves these headaches without eliminating local choice. It curbs wasted spend, closes compliance gaps, consolidates data into one stream, and restores the buying power that naturally comes with scale.

Audit your company’s SaaS usage today

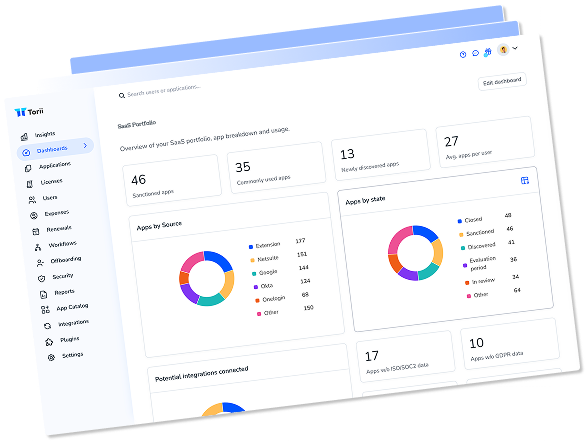

If you’re interested in learning more about SaaS Management, let us know. Torii’s SaaS Management Platform can help you:

- Find hidden apps: Use AI to scan your entire company for unauthorized apps. Happens in real-time and is constantly running in the background.

- Cut costs: Save money by removing unused licenses and duplicate tools.

- Implement IT automation: Automate your IT tasks to save time and reduce errors - like offboarding and onboarding automation.

- Get contract renewal alerts: Ensure you don’t miss important contract renewals.

Torii is the industry’s first all-in-one SaaS Management Platform, providing a single source of truth across Finance, IT, and Security.

Learn more by visiting Torii.